Company Registration In Pakistan

Registering a company in Pakistan may seem complex at first glance, but the process has become much more streamlined thanks to the digital transformation introduced by the Securities and Exchange Commission of Pakistan (SECP). With the right approach and preparation, you can successfully incorporate your business in just a few days without unnecessary delays.

Choosing the Right Structure

The first and most important step is choosing the right legal structure for your business. This foundational decision affects how your company will be owned, governed, and taxed. In Pakistan, business owners can select from multiple entity types based on their business model, scale, investment size, and long-term vision.

Limited Liability

A Limited Liability Company (LLC) is a highly favored choice among entrepreneurs due to its flexible structure and built-in asset protection. This format is especially suitable for medium and large enterprises, offering a blend of a partnership’s operational ease with the legal safeguards of a corporation. The owners’ liability is restricted to their invested capital, significantly lowering personal financial risks.

Private Company

The Private Limited Company (Pvt Ltd), governed by the Companies Act, 2017, requires at least two individuals to incorporate. It offers a structured corporate setup with defined governance protocols, limited liability, and the option to raise capital through shareholders. However, this type of company is restricted from offering shares to the general public or trading on the stock exchange.

Public Limited Company

A Public Limited Company (PLC), in contrast, can raise funds from the general public and list its shares on the stock exchange. This structure is better suited for large corporations with growth ambitions tied to public investment. A PLC must have a minimum of three directors and adhere to strict financial and regulatory reporting requirements.

Single Member Company (SMC)

For individuals operating alone, the Single Member Company (SMC) is the ideal solution. Formed by a single individual, it offers full ownership and all the corporate advantages such as legal identity and limited liability. This structure is popular among freelancers, consultants, and solo professionals seeking a formal business identity.

Each type of business entity serves a different purpose. Your selection will depend on your business objectives, the number of founders, your funding strategy, and your tolerance for compliance. Fortunately, the Companies Act allows business owners to upgrade or change their structure as their business evolves.

Understanding the strengths and legal benefits of each structure helps ensure compliance and paves the way for long-term success. With SECP’s modernized systems and proper support, registering a company in Pakistan is now a smoother and quicker process.

Choose a Company Name

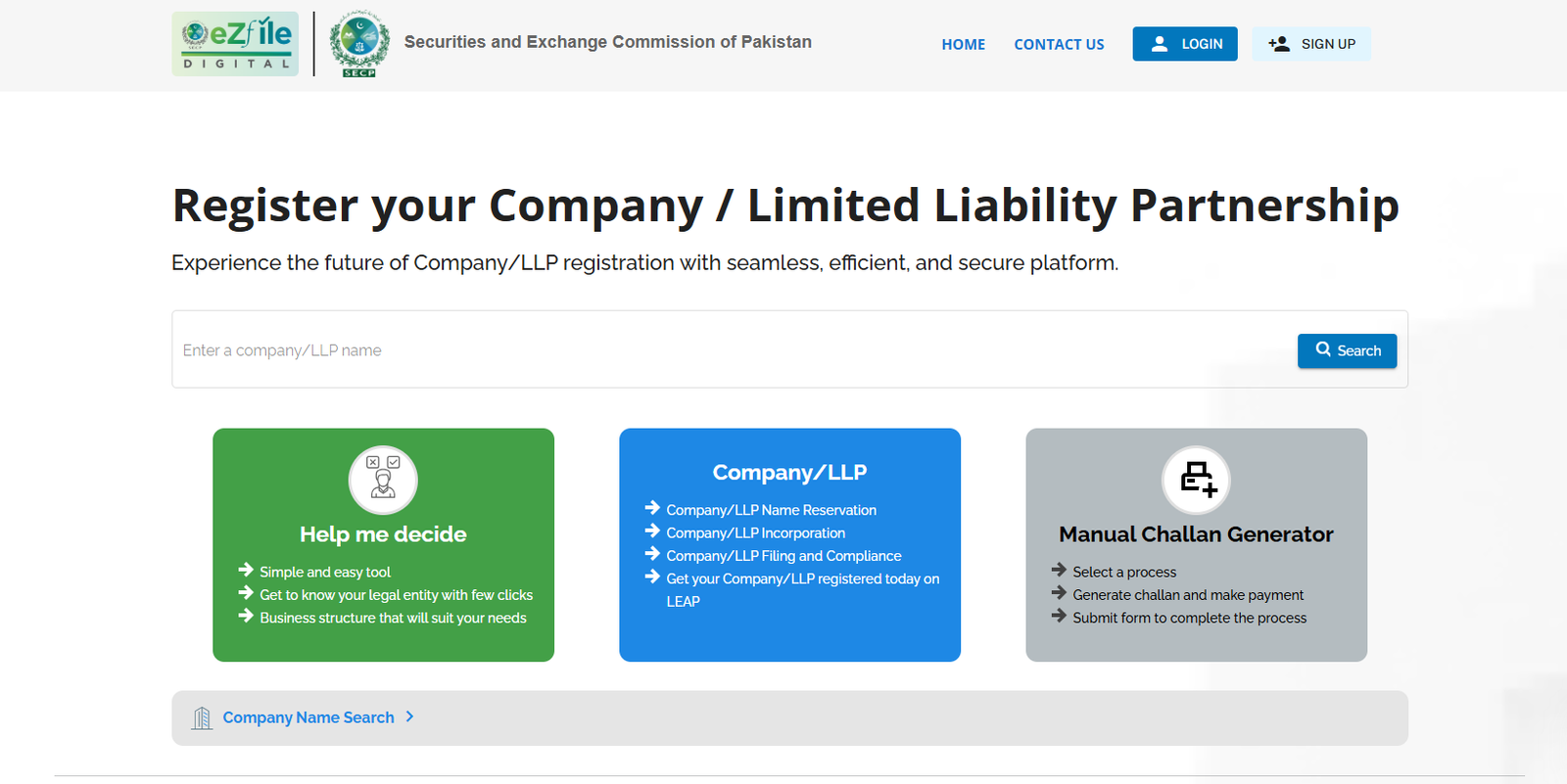

Selecting and registering your business name through SECP is a critical step in formalizing your company. Use the SECP e-services portal to reserve your company name, where you can also search for name availability. You must propose three names in order of preference. These names should be unique, non-offensive, and not closely resemble any existing company name.

The name reservation fee is PKR 1,150 and can be paid online or at authorized bank branches. Choose a name that accurately represents your business, is easy to remember, and aligns with SECP’s naming guidelines.

Prepare Required Documents and Apply

To move forward with company registration, you must prepare and submit the following documents:

Memorandum of Association (MOA): Describes your company’s objectives and business activities

Articles of Association (AOA): Lays out the internal rules, governance structure, and responsibilities of directors and shareholders

Form 1 (Declaration of Compliance): Certifies that all requirements under the Companies Ordinance, 1984, have been fulfilled

Form 21 (Notice of Registered Office): Notifies SECP of the company’s official address

Form 29 (Particulars of Officers): Lists details of directors and key officers

Supporting Documents:

Scanned CNICs of all directors

Fee deposit slip or online payment receipt

Registration Fees:

The total registration fee depends on the authorized share capital of the company. Different capital brackets carry different fee structures for Private Limited and Single Member Companies.

Get a Digital Signature Certificate

Acquiring a Digital Signature Certificate (DSC) expedites your company registration by allowing you to sign documents electronically. It eliminates the need to physically visit SECP offices. You can apply for a DSC through NIFT (National Institutional Facilitation Technologies) after securing the Company Name Reservation Certificate.

Obtain a Certificate of Incorporation

Once your documents are submitted and the registration fee is paid, SECP begins the review process. It verifies all submitted information, including director profiles, legal documentation, and compliance.

If there are any discrepancies or missing details, SECP will notify you via email through the eZfile portal. You’ll be required to correct and resubmit the application. Upon resubmission, the process may take up to seven working days.

If the application is complete and meets all regulatory requirements, SECP will issue a Certificate of Incorporation. You can collect it from an SECP facilitation center or receive it via courier at your registered address within seven working days.

Registration for Taxes (NTN)

Getting a National Tax Number (NTN) from the Federal Board of Revenue (FBR) is mandatory to operate legally in Pakistan. It’s required for paying taxes, opening a corporate bank account, and applying for government services.

To apply, visit the FBR’s IRIS portal. Provide your business name, address, contact details, and for individuals, CNIC; for companies and AOPs, provide incorporation documents and ownership details. Make sure to select the correct taxpayer type.

Upon successful submission, your NTN and registration certificate will be generated and available for download on the IRIS portal. This ensures compliance with tax laws and enables your business to file returns, apply for loans, and operate transparently

Open a Corporate Bank Account

After obtaining your NTN, you can set up a business bank account to manage your company’s financial operations. Choose a bank that aligns with your business needs and offers suitable online and offline services.

Documents required include:

Certificate of Incorporation issued by SECP

National Tax Number (NTN)

Memorandum of Association (MoA)

Articles of Association (AoA)

CNIC copies of directors and authorized signatories

Board Resolution authorizing account opening (if required)

Once the account is opened, shareholders can deposit their capital contributions into the company’s account.

Apply for Business Permits and Licenses

Once incorporated, your business may require the following licenses:

General Business License: Apply to the local municipal authority with business and location details

Trade License: Required for trading businesses and issued by the relevant authority

Health and Safety Permit: Mandatory for food and beverage businesses, issued by the local health department

Environmental Permit: Required for businesses impacting the environment, issued by the Environmental Protection Agency

Fire Safety Certificate: Issued by the local fire department after verifying safety measures

Common Challenges When Registering a Company in Pakistan

Business Registration Challenges

Choosing the right business structure (Sole Proprietorship, Partnership, SMC, Private Limited) can be confusing for new entrepreneurs

Lack of awareness about mandatory tax and regulatory registrations (NTN, STRN, PSEB, etc.)

Difficulty understanding SECP’s e-services portal and online filing procedures

Opening a business bank account can be delayed due to incomplete documentation or lack of familiarity with bank requirements

Solutions

Research each structure or consult a business advisor to determine which type best suits your business goals and liability preferences

Create a checklist of all post-incorporation registrations and consult tax professionals to ensure full compliance

Use SECP’s official tutorials or hire a consultant who can file your incorporation documents through the e-portal efficiently

Contact the bank in advance to get a complete list of requirements and ensure all documents are properly attested and up to date

FAQs

Can a foreigner register a company in Pakistan?

Yes, a foreign national can register a company in Pakistan. Along with the standard documents, they must submit attested copies of their passport and proof of residence

How can I verify if a company is registered in Pakistan?

You can verify a company’s status through SECP’s online company search portal by entering the business name to access registration details

Is it possible to convert a sole proprietorship into a private limited company?

Yes, a sole proprietorship can be converted into a private limited company. Similarly, a private limited company can be upgraded to a public limited company, subject to legal documentation and compliance with SECP procedures

Register Your Company in Pakistan Today – Take the First Step to Success

Ready to launch your business without stress? With the right guidance, company registration is smooth and worthwhile.

Need help with paperwork, legal compliance, or tax registration? The expert consultants at CRO are ready to assist you. Get in touch for professional support today.